An overview of taxation of investments in equity crowdfunding

In this guide, we have summarized the most important information and frequently asked questions to provide an overview of the tax treatment of income from your Companisto investments. We address investments by both private investors and corporations and also explain the regulations that apply to investors from Austria and Switzerland.

If you have any other questions, you can contact our customer relations team at service@companisto.com.

Tax guide for equity crowdfunding – Taxes on capital earnings

How are private investors’ earnings from equity crowdfunding taxed?

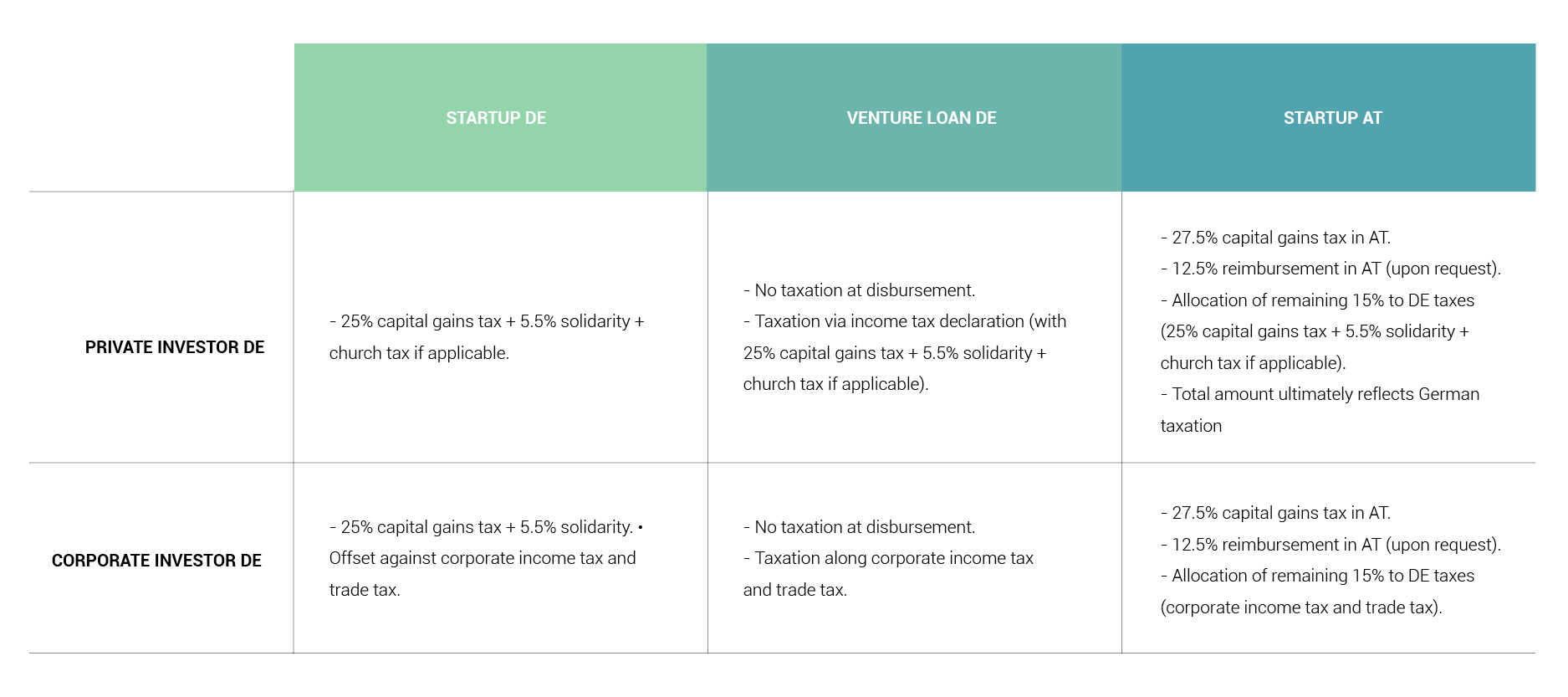

There is a distinction between startup participations in the form of partial subordinated loans and venture loans in the form of subordinated loans. Dividends for startup holdings are generally subject to German capital gains tax (25%) and the solidarity surcharge (5.5% on capital gains tax) and, if applicable, church tax (8% or 9% on capital gains tax, depending on the federal state). In total, this results in a total tax burden of 26.38% due to capital gains tax and the solidarity surcharge. [1] These taxes are paid directly by the startups.

In equity crowdfunding via venture loans, no tax is deducted from the distribution for tax reasons, which is why you are responsible of declaring this income as part of your income tax return (attachment KAP) and, if necessary, tax it yourself. The same tax rates apply to the capital gains tax, solidarity surcharge and church tax as for the tax on partial subordinated loans, i. e. a total tax burden of 26.3%.

[1] In case of church tax liability, this overall tax burden is, of course, correspondingly higher.

Equity crowdfunding - Tax exemption from taxes on investment income

You can request an exemption request from the startups. You can do this here on our platform, but only for investments where a tax is due at payout. An exemption order is not possible for venture loan investments, but only for the classic startup investments. [2] Please also note that exemption orders can only be issued by private crowd investors who are liable to taxation in Germany and only for investments in German companies. You can request the exemption order via this link via our platform.

[2] For tax reasons, however, this applies only to partial subordinated loans.

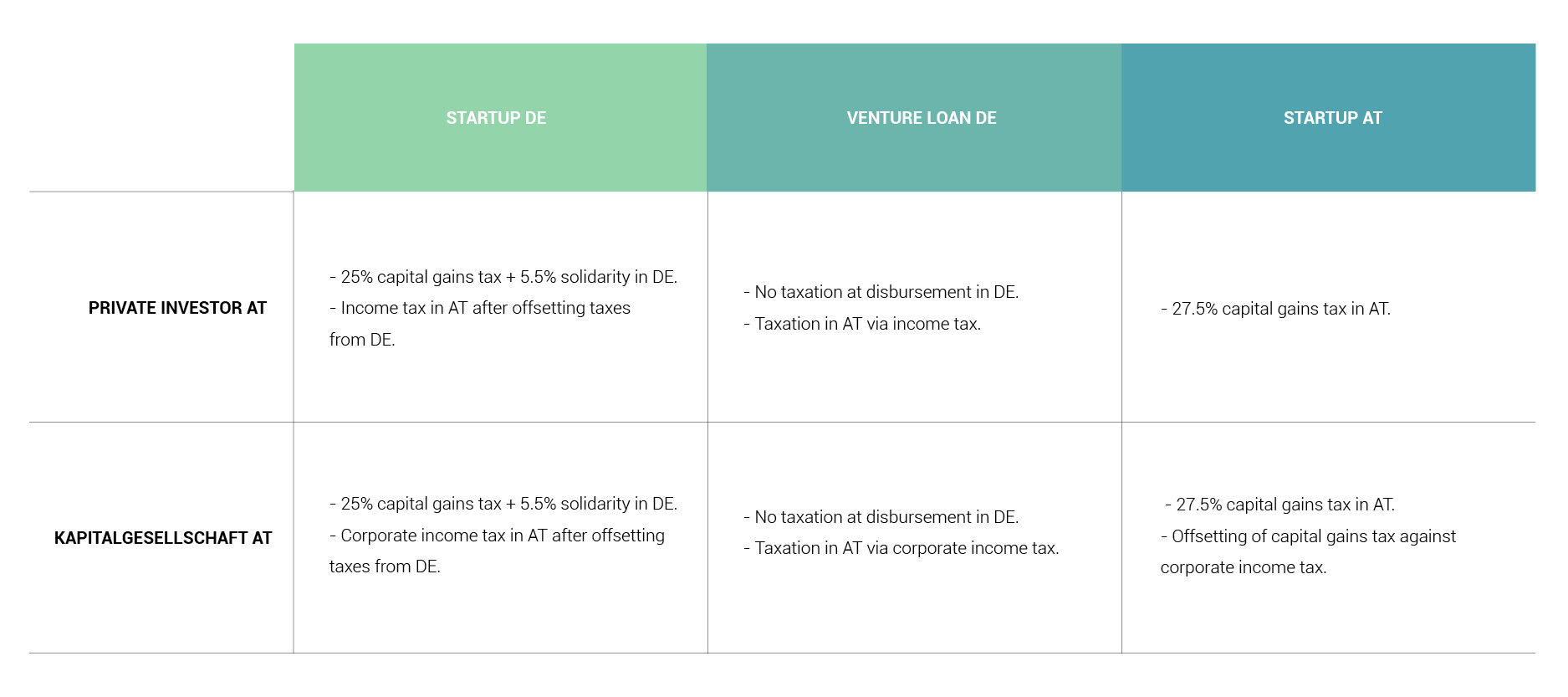

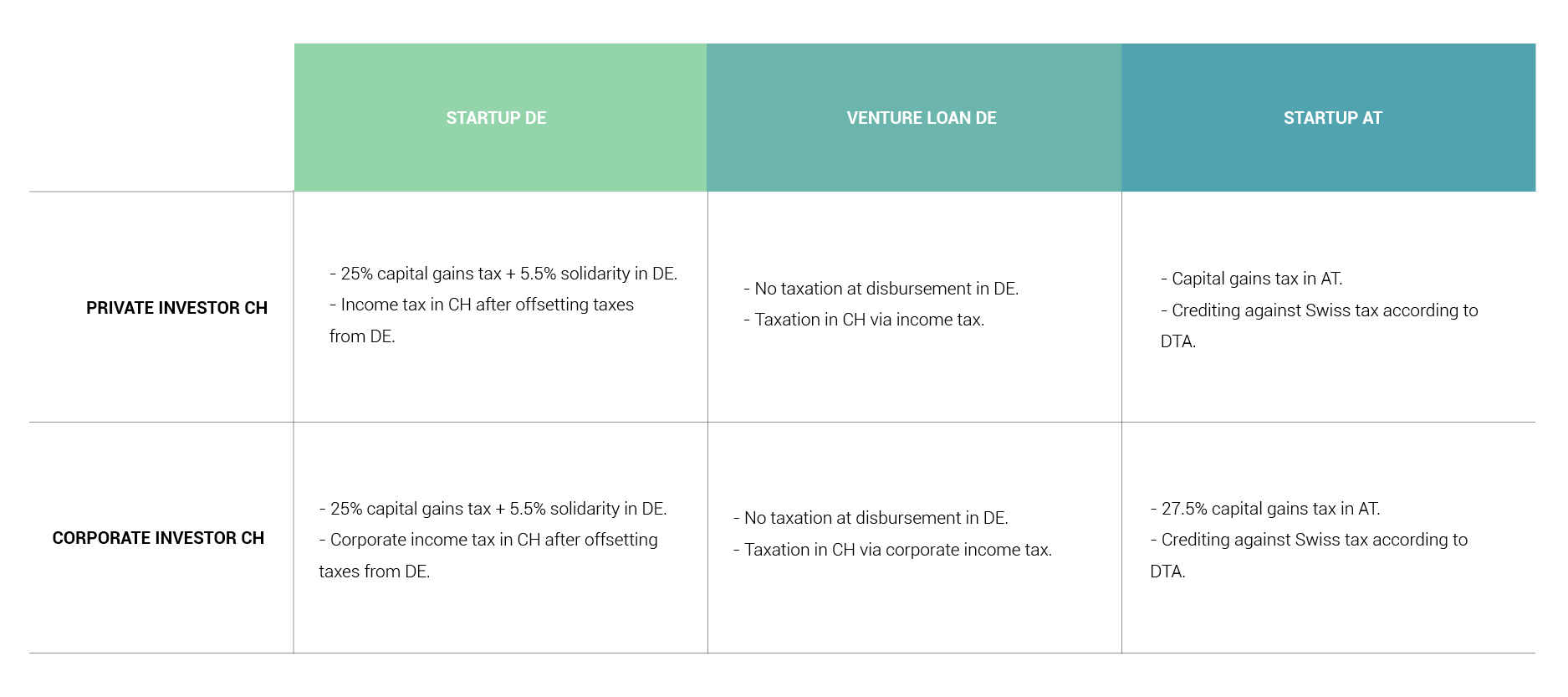

Tax guide for equity crowdfunding – Tax regulations in Austria and Switzerland

If a private Austrian or Swiss crowd investor invests in a German startup company, the income will initially be taxed at a flat rate in Germany within the scope of source taxation with 25% capital gains tax and 5.5% solidarity surcharge (i. e. with a total of 26.38%). In Austria, the next step is declaring the corresponding investment income within the framework of income tax and offsetting the taxes already paid in Germany against the existing double taxation agreement (DTA). A similar procedure applies to the Swiss income tax assessment for Swiss investors. To the best of our knowledge, it should be impossible for profits to be taxed twice in both cases. Additional information can be found on the website of the Bundeszentralamt für Steuern (Federal Central Tax Office).

Income from investments by Austrian corporations in German startups is initially taxed in Germany with capital gains tax and solidarity surcharge and is then subject to corporate income tax (25%) in Austria. Taxes withheld in Germany are deducted up to a maximum amount of the taxes payable in Austria (i. e. up to 25%). This means that the German tax rate (26.38%) is actually applied. The declaration of the tax payable must be made by the corporation itself.

Tax guide for equity crowdfunding – Regulations for investments of German corporations

Income from investments by German corporations through equity crowdfunding on Companisto is generally subject to corporation tax and trade tax. Like income from private crowd investors, income from corporations is initially subject to capital gains tax (25%) and the solidarity surcharge (5.5% on capital gains tax), but not to church tax. These taxes paid are directly by the startup companies on the investment company's capital gains and can then be offset against corporate income tax and trade tax.

As with private crowd investors, income from venture loans is not subject to any tax on their disbursement, which is why they are still subject to being taxed as part of the capital gains tax declaration and trade tax return. The same tax rates apply here as for income from participatory loans (see the previous paragraph).

Tax guide for equity crowdfunding in Austria

What about equity crowdfunding in Austrian startups is different for German investors?

Again, one distinguishes between investments by private individuals and investments via corporations. Both private investors and corporations from Germany pay a flat-rate withholding tax (27.5 %) on all income due in Austria and can have 12.5% of the taxes paid reimbursed by applying to the competent tax office in Austria thanks to the existing double taxation agreement.

In Germany, the gross income of private individuals is taxed as income from capital investment with 25% capital gains tax plus 5.5% solidarity surcharge and church tax, if applicable. The gross income from equity crowdfunding investments by German corporations is subject to corporation tax and trade tax.

In Germany, 15% of withheld taxes from Austria can be deducted from both private investors and corporations, to avoid double taxation - if the investor asks the tax authorities in Austria to refund the remaining 12.5% of withheld tax. This way, taxes are payable at the German tax rate, i. e. a total of 26.38% plus church tax (if church tax liability exists). Tax returns in Germany are to be submitted by German private individuals and corporations themselves.

What rules apply to private investors and corporations from Austria investing in Austrian startups?

Income from equity crowdfunding investments by Austrian private investors is subject to the Austrian capital gains tax of 27.5%. An additional tax return is not necessary since the tax is paid directly by the startup company as a withholding tax.

The Austrian withholding tax (27.5%) is withheld from income from equity crowdfunding investments by Austrian corporations and credited against the corporation tax of the corporation. If the corporation tax is lower than the amount of capital gains tax already paid, the difference will be refunded.

Tax advisor – Special features of the tax on investment income at a glance

Tax advisor for equity crowdfunding – How can I optimize the taxation of my earnings?

Investing via a corporation (e.g. GmbH or UG) rather than as a private individual can have tax advantages. This is because corporate investments have the option of offsetting any losses from equity crowdfunding on Companisto against income from other investments, which reduces the entire tax burden.

Note: The information contained in this information sheet is for informational purposes regarding the taxation of your income on Companisto only. It is not to be understood as tax advice and therefore cannot replace such advice. All information is provided without guarantee.

Status as of 01.12.2016 00:00

Current investment opportunities

Would you also like to invest in innovative companies?

_315_209.jpg)

Comments

Only registered Companists can comment. Please log in to leave a comment.