how to participate in

Startups and Growth

Companies on

Companisto

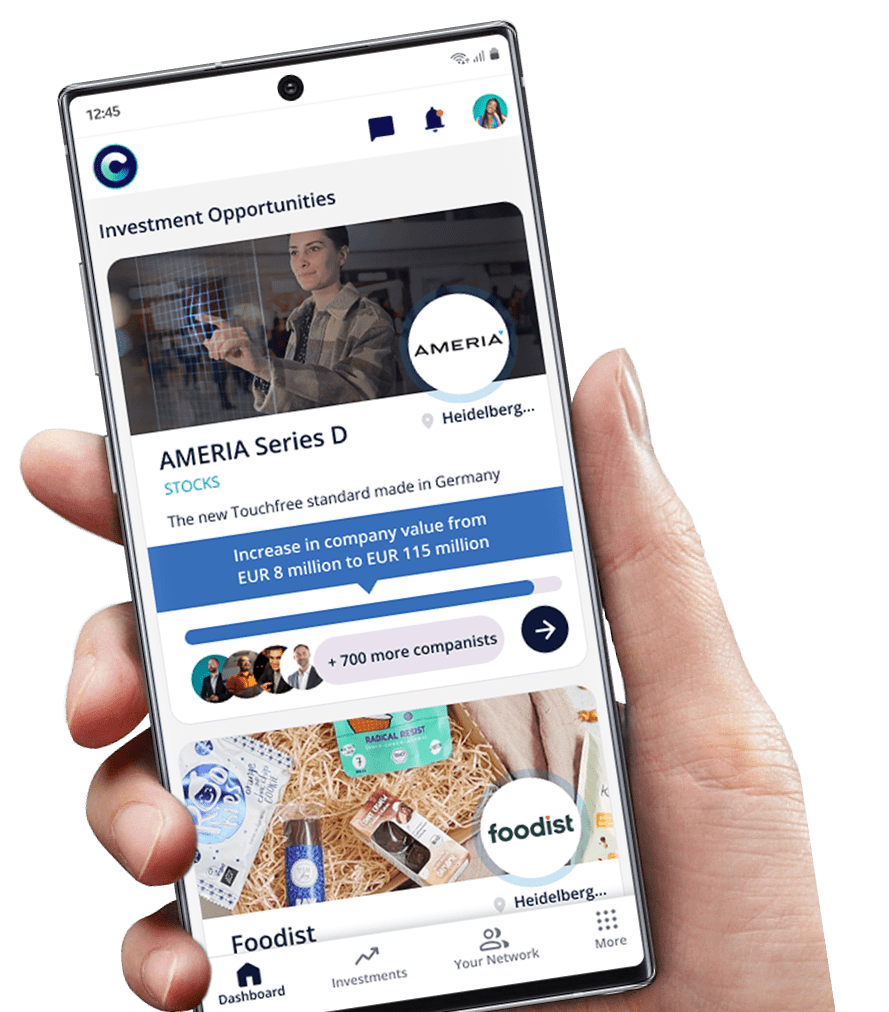

The development of successful companies requires good ideas, capable entrepreneurs and sufficient capital. Companisto is a network specializing in private venture capital investments in companies.

How it Works

On this page we show you how easy it is to participate in startups and growth companies online on Companisto.

Investing in Innovation

Together

Selection

On our platform, you choose which startup or growth company you want to invest in.

Investment

You invest an amount of your choice in the selected company.*

Yield

opportunity

You as investor will receive company shares.**

Detailed Description

These Participation Models are

Available on Companisto

Here is an overview of our investment models:

| Standard Participation | Angel Shares | |

|---|---|---|

| Minimum investment | from € 250 | from € 10.000 |

| Type of investment |

shares or participation certificates | shares |

| Financing volume |

up to € 8 million per year | unlimited |

| Return on investment: Profit and exit participation |

||

| Investor pooling | ||

| Matching with state VCs and subsidies |

||

| 15% state INVEST grant |

selection of companies

How are Startups and

Growth Companies selected

on Companisto?

on

requests documents from interesting companies.

to get a personal impression.

attractive investment conditions.

Companisto.

about investing

Invest Like

Professional Investors

Companisto is

a Reliable Partner

about investing

Why is it Important to Invest in Startups and Growth Companies?

From our point of view, investments in startups and growth companies are a task for society as a whole that serves to facilitate groundbreaking innovations in Germany. We are competing internationally for the companies of the future. At the same time, many industries are under pressure. It is the responsibility of all of us to strengthen Germany as a place of business in the long term.

An important part of this are private investments in young companies. Many of the upcoming blue chips in Germany are already in the hands of international investors. We are committed to countering this trend. We get involved in early phases of a company's development to make groundbreaking innovations possible and to accompany later growth.