How do you evaluate an investment?

Most investors responsible for their own asset accumulation look at one thing above all else: profit. This article intends not only to point out investment opportunities with strong returns but also to provide food for thought on how to assess investments – in addition to focusing on returns.

Profit and the risk-return ratio

Let’s start with the risk-return ratio. Most investors evaluate investments by the profit achieved. The stock exchange encyclopedia defines profit as the yield a capital investment makes within a fixed time period. Investors use this key figure to check how successfully their investments have developed over time. It usually refers to a full year and is expressed as a percentage.

If the investment made yields a higher return than a comparable investment, it is considered profitable and the investor is pleased. On the other hand, if it is worse than the comparative investment, it is considered unprofitable and the investor is disappointed. However, the focus on returns often obscures the view of other factors that influence an investment. One of these factors is investment risk.

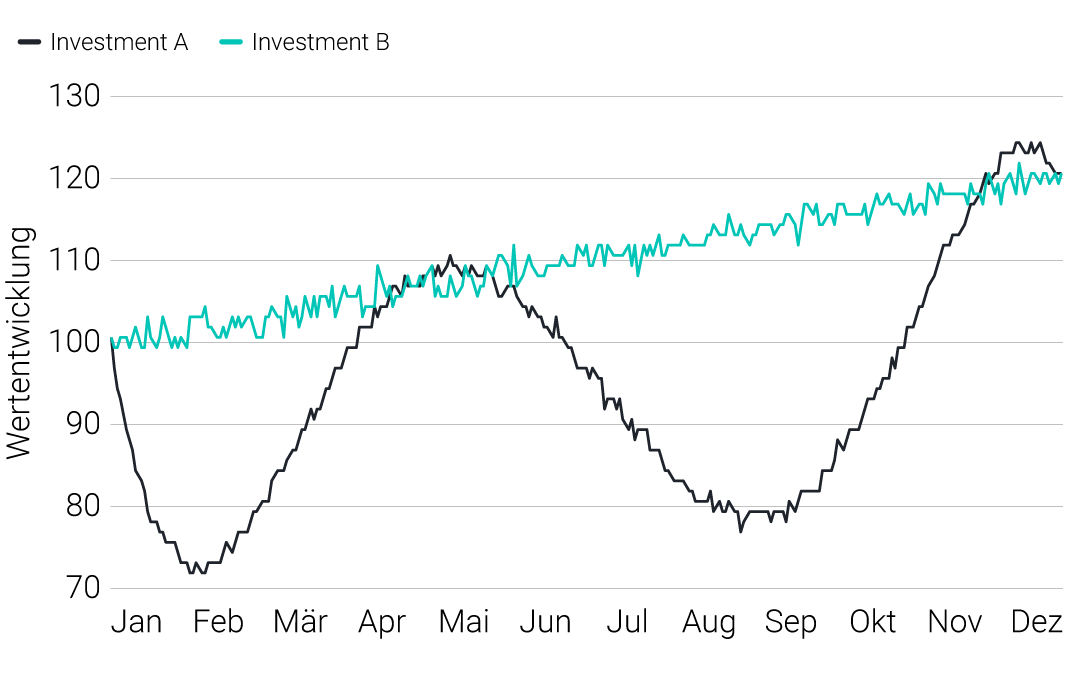

Why not look at a ratio that shows return in relation to risk rather than just comparing returns? This makes it easier to compare investments that yield the same return. Professor Dr. Stefan Mittnik, co-founder of Scalable Capital, illustrated this:

Both investments have the same final return. However, Investment A develops with very large fluctuations, whereas Investment B shows constant growth with little fluctuation. Depending on your investor personality, high fluctuations in the portfolio can be emotionally stressful. Also, if you had to sell the investment at short notice in order to free up cash, you could catch an unfavorable time and make losses.

„The question is: How much more return than B would A have to yield for you to accept its strong fluctuations? Would you choose A if the investment yields 1% more than B? Probably not. At some point, however, the relationship tends to flip. Those who think ahead that far are on the right track," “, says Mittnik.

The risk/return ratio can be calculated using three key figures: The Sharpe ratio, the Sortino ratio and the return drawdown ratio. The Sharpe ratio is the best-known figure for the risk/return ratio. It looks at the excess return, i. e. the return that a risk-free investment produces, and compares it to the risk of this investment.

In order to calculate the Sharpe ratio, you first determine the excess return on the investment in relation to the risk-free interest rate. The result is compared with the risk of the investment. This risk is expressed in terms of volatility, a value that describes how much the returns on the investment fluctuate. The higher it is, the better the ratio between return and risk. You can find the mathematical equation for the Sharpe-Ratio in our glossary.

The three figures are particularly suitable for investments in equities and active and ETFs (exchange-traded funds). Since these are traded on the stock exchange, their prices are visible to all investors. However, it is difficult to apply the three figures to long-term investments that are not traded on the stock exchange because there often is not enough data to calculate them.

Is high return equal to high risk?

The market saying „the higher the return the higher the risk“ is probably the best-known principle for financial professionals. When volatility – i.e. the fluctuation of an investment’s risk – is added, things become more complex. Suddenly, investments with the same final return are at different levels of risk, as in the example described above.

Mittnik has a simple tip for investors: „It pays off to invest in shares at low risk - and to say goodbye to certain shares when their risk increases.” “ However, investors cannot constantly be determining the risk on the stock markets, comparing it with the long-term average, and adjusting their portfolios accordingly.

Strong returns with these investment opportunities

The risk for investments such as call money or fixed-term deposits is very low. Accordingly, their returns are low, too. By contrast, investment opportunities that generate a strong return ultimately are investments in people: Equities, equity funds, ETFs, mutual funds and corporate bonds are investments in entrepreneurs. Since there are many factors that influence the success of a company, these investments generally bear higher risks.

Real estate, commodities or tangible assets are also investment opportunities that can yield a relatively high return. Recent years saw the addition of cryptocurrencies and private loans (peer-to-peer lending). Investments in startups, i. e. companies that are not yet listed on the stock exchange, are also considered high-yield investments. Very high risks accompany the above-average high returns, which is why they are considered venture capital.

Making returns with equity crowdfunding

Equity crowdfunding platforms have been active in Germany since 2011. These Internet service providers enable private individuals to invest in startups and growth companies. They provide information about the product, the business model, financial figures and planning, founders and team and their previous experiences, the market and target group, and about their technology and strategy.

Investors can make an investment decision based on this data, a pitch video, and direct contact with the founding team. This is called equity-based crowdfunding because many private investors invest collectively.

Like most high-risk investments, equity crowdfunding investments in startups are long-term investments. The minimum contract term on most platforms is eight years and the financial participations are paid out on final maturity. Investors can follow the development of the company in real time. When the company is sold, taken over or traded on a stock exchange, they receive a percentage of the proceeds.

Do you want to know how to invest in startups? We'll show you how.

Status as of 11.08.2017 12:44