Known from the documentary

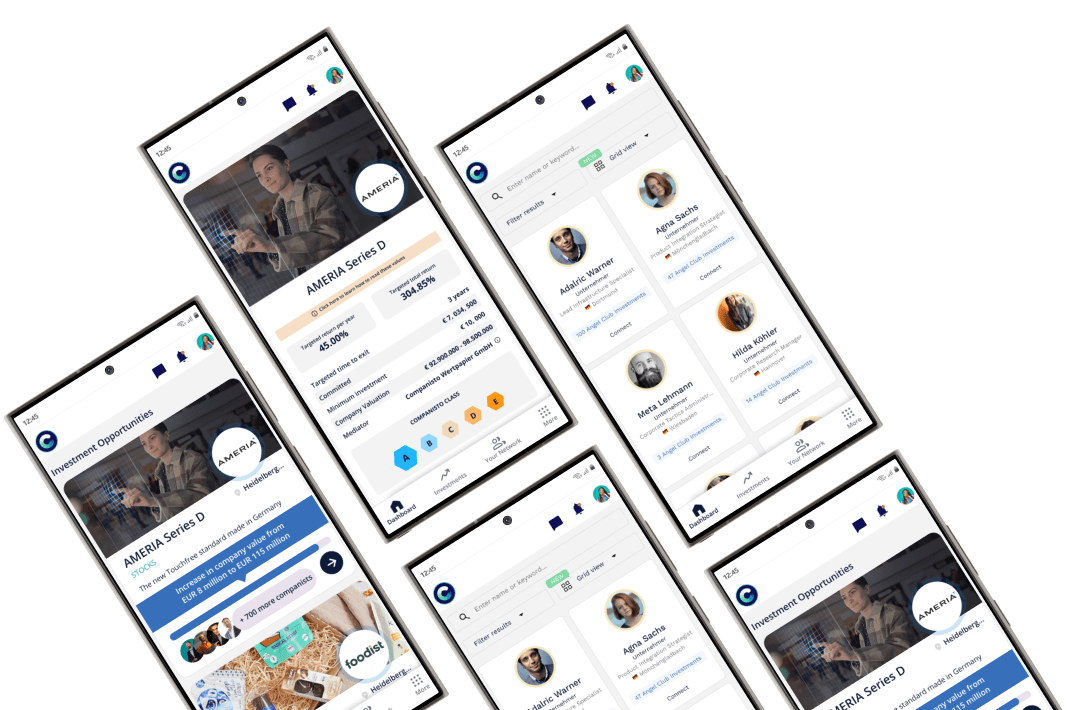

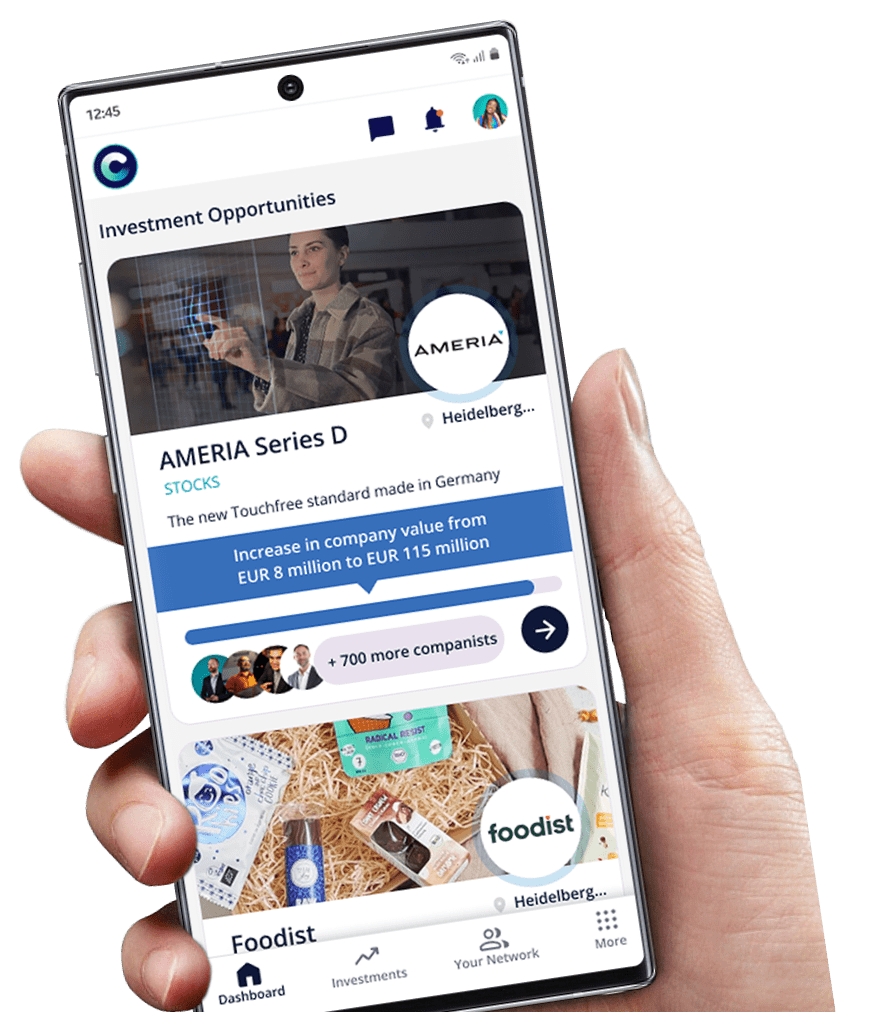

Current investment opportunities

Startup and Investor Events

Please be welcome and participate in one of our exciting events around the topics of startups, financing and venture capital.

Die Finanzwelt ist nichts für junge Mädchen? Das sehen wir anders! Du erlebst ein Stück Alltag einer Gründerin und kannst dir eben ...

Event ended

Wie wird aus einer Online Food Brand ein Retail Player. FREDA zeigt, wie der Schritt ins Tiefkühlregal gelingt und warum Listings ...

Registered participants: 9

Event ended

Exclusive event “Inside the FDA: Strategy and Guidelines” with Adam Saltman, former Medical Officer at the US FDA (12 years). He p ...

Registered participants: 5

Status of our Investments

Largest investor network in Germany

With over 100,000 members, we are Germany's largest investor network for start-up investments. On our platform you will find selected start-ups in which you can invest online.

About us

Managing Director

Managing Director

Head of Investment